What Kind of Moving Expenses Can Be Claimed on Your Taxes?

Understanding Moving Expenses on Taxes in 2025

Relocating for work or other reasons can be costly, and you might wonder if you can recoup some of these expenses through tax deductions.

Understanding which moving expenses on taxes are deductible can potentially save you money during tax season. However, significant changes in tax law have affected how these deductions work for most taxpayers.

At One Accounting, we help clients navigate the complexities of tax deductions, including the current rules surrounding moving expenses. This comprehensive guide will explain what you need to know about claiming moving expenses on your 2025 tax return.

Before we dive into the exceptions, let’s explore how the current tax law has reshaped moving expense deductions.

Current Tax Law on Moving Expense Deductions

The Tax Cuts and Jobs Act (TCJA) of 2017 dramatically changed the landscape for moving expense deductions. For most taxpayers, the ability to deduct moving expenses was suspended from 2018 through 2025. This means that unless you fall into specific exception categories, you cannot claim moving expenses on taxes for your federal return during this period.

Before this change, taxpayers could deduct qualifying moving expenses if they moved for work-related reasons and met certain distance and time requirements. Millions of Americans who relocate for work each year have been affected by the current suspension.

Let’s look at who still has the privilege of writing off these costs and how you can possibly benefit.

Who Can Still Claim Moving Expenses on Taxes?

While most taxpayers cannot deduct moving expenses until potentially after 2025, there are important exceptions as listed below:

Active-Duty Military Members

If you’re an active-duty military member moving due to a Permanent Change of Station (PCS), you remain eligible to deduct qualifying moving expenses on your federal tax return. A PCS includes the following:

- A move from your home to your first active-duty post

- A transfer from one permanent post to another

- A move from your last post to your home or to a closer location in the United States

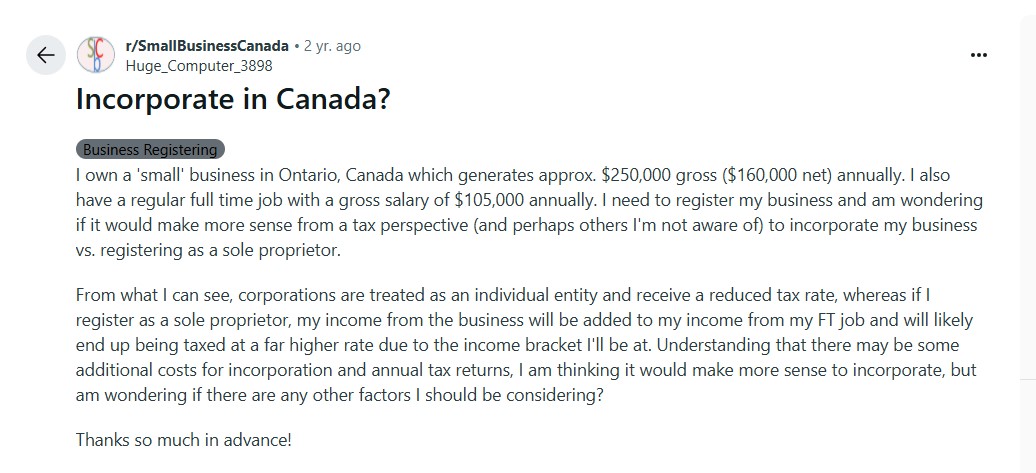

Here is a Reddit thread that further expands on how to claim taxes on moving expenses.

This military exception recognizes the unique challenges faced by service members who must relocate frequently as part of their duties.

State-Specific Deductions

Even if you can’t claim moving expenses on your federal tax return, some states still allow these deductions on state tax returns. States don’t always conform to federal tax law changes, creating opportunities for tax savings at the state level.

For example, states like California, Massachusetts, and New York have their own rules regarding moving expense deductions. If you’ve relocated within or to one of these states, you might be eligible for state tax benefits even when federal deductions aren’t available.

Now let’s break down exactly what kinds of expenses you might still be able to claim if you qualify.

Eligible Moving Expenses for Qualified Individuals

For those who qualify (mainly active-duty military), the following expenses can typically be claimed:

Transportation and Storage of Household Goods

- Costs of packing, crating, and transporting personal belongings and household items

- Expenses for shipping cars and pets to your new home

- Storage fees for household goods for up to 30 days immediately after moving out or before delivery to your new home

Travel Expenses

- Lodging costs during the move

- Transportation expenses for yourself and household members from your old home to your new home

- Gas and oil expenses if using your vehicle for the move, or the standard mileage rate for moving purposes

Note that meal expenses incurred during the move are not deductible, even for those who qualify for the moving expense deduction.

It’s just as crucial to know what you can’t deduct, let’s save ourselves some trouble by getting clear on that.

What Moving Expenses Cannot Be Claimed on Taxes

Understanding which expenses don’t qualify is equally important. The following costs cannot be claimed as moving expenses on taxes, even for those who qualify for the deduction:

- Home buying or selling costs (including real estate agent fees)

- Home improvements to help sell your house

- Losses from selling your home

- Expenses related to breaking or entering into a lease

- Security deposits and mortgage penalties

- Return trips to your former residence

- Pre-move house hunting expenses

- Temporary living expenses at the new location

Let’s get into the nuts and bolts of how these reimbursements are handled depending on your situation.

Employer Reimbursements and Tax Implications

The tax treatment of employer reimbursements for moving expenses depends on your situation:

- For active-duty military: Qualified reimbursements for deductible moving expenses are generally excluded from income

- For all other employees: Under current tax law, employer reimbursements for moving expenses must be included in your taxable income and are subject to income and payroll taxes

Employers adjusted their relocation policies in response to the TCJA; some increased compensation to offset the additional tax burden that employees face when receiving moving expense reimbursements.

With those details in mind, here’s how you can go about claiming those expenses.

How to Claim Moving Expenses on Taxes

For Active-Duty Military Members

If you’re an eligible military member, you can claim your moving expenses by:

- Completing IRS Form 3903 (Moving Expenses)

- Attaching it to your federal tax return

- Reporting any employer reimbursements for moving expenses

For State Tax Returns

If your state allows moving expense deductions:

- Check your state’s tax department website for specific forms

- Follow state-specific guidelines for documentation and filing

- Determine if your state uses the same criteria as pre-2018 federal rule

The tax treatment of employer reimbursements for moving expenses depends on your situation:

- For active-duty military: Qualified reimbursements for deductible moving expenses are generally excluded from income

- For all other employees: Under current tax law, employer reimbursements for moving expenses must be included in your taxable income and are subject to income and payroll taxes

Employers adjusted their relocation policies in response to the TCJA; some increased compensation to offset the additional tax burden that employees face when receiving moving expense reimbursements.

With those details in mind, here’s how you can go about claiming those expenses.

Documentation and Record-Keeping

Whether claiming moving expenses on federal or state returns, proper documentation is crucial:

- Keep all receipts related to your move

- Maintain records of distances between locations

- Save documentation of military orders (for active-duty personnel)

- Retain employment records showing the reason for your move

Good record-keeping will support your deduction claims and prove invaluable if you face an audit. One Accounting can help you organize and maintain these critical records.

Finally, let’s future-proof your knowledge and see what changes might affect you down the line.

Future Considerations for Moving Expenses on Taxes

The suspension of moving expense deductions for most taxpayers is scheduled to expire after 2025. Without further legislative action, the deduction could return in 2026 under pre-TCJA rules. However, tax laws frequently change, so it’s essential to:

- Stay informed about potential tax law changes

- Consult with tax professionals about planning for future moves

- Consider the timing of relocations if possible

Conclusion

While most taxpayers cannot currently deduct moving expenses on their federal tax returns due to the TCJA suspension through 2025, important exceptions exist for active-duty military personnel and potentially on state tax returns. Understanding which moving expenses on taxes might be deductible in your specific situation can lead to significant tax savings.

For personalized guidance on your moving expenses and comprehensive tax planning, contact One Accounting today. Our team of certified professionals will help you navigate tax complexities and maximize your potential deductions while ensuring full compliance with all applicable tax laws.