What to Expect If You're Audited Without Receipts?

Have you ever wondered what happens if you’re audited and don’t have the necessary receipts to back up your claims? It’s a situation that can cause anxiety for many, but understanding the process and potential outcomes can help you navigate it with more confidence.

If you’ve received a letter from the CRA requesting a tax audit, your first reaction might be complete fear. Verify that the letter you are holding is really from the CRA.

The best way to do this is to call the person who sent the letter. Use the details given to ask for their name, phone number, and office location. After that, call the usual CRA business support number at +1 800 959 5525.

Check the details with the person who answers. Continue reading to learn what happens if you get audited and don’t have receipts.

Understanding whether you’re being audited by the CRA can feel overwhelming, so let’s break it down step by step under the heading ‘How Do I Know if I am Being Audited by the CRA?

How Do I Know if I am Being Audited by the CRA?

Notifications from the CRA are sent via mail rather than by phone or email. You will get a notice with details about why your return is being reviewed. It will say what documents, if any, they need from you. It will also explain what steps to take next.

The CRA may accept your tax return as filed or make adjustments when it has finished its investigation. These modifications could have an impact on how much tax you owe or how much you are refunded.

Don’t wait for an audit notice to learn about the process. Let’s explore how the CRA conducts audits so you can be prepared.

How does the CRA do an audit?

A CRA auditor will contact you to start the audit process. They will also tell you the date, time, and place of the audit.

An on-site audit typically happens in your home, place of business, or representative’s office. The auditor will show you an authentic identification card before beginning the audit.

The purpose of an audit is to check if the taxpayer reported their income correctly. It also ensures they claim the right deductions and credits. Finally, it confirms they followed the tax rules.

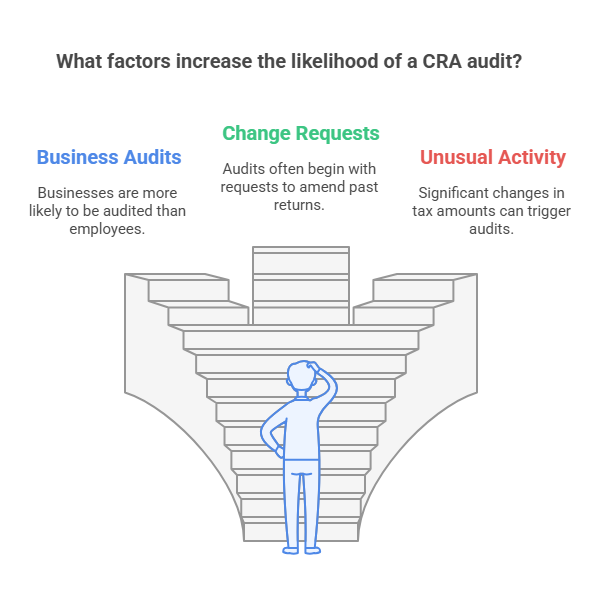

Who Gets Audited By the CRA?

- The Canada Revenue Agency (CRA) can investigate and audit anyone responsible for paying taxes to them.

- Businesses are much more likely to be audited than employees. Most audits begin when a request is made to change a past return.

- Also, unusual activity can trigger an audit e.g. HST is always a payable amount every quarter, but suddenly drops to a large refund in one quarter.

Being unprepared can make the process much more stressful. So, what happens if you’re being CRA audited and don’t have receipts?

What Happens if I’m Being CRA Audited and Don’t Have Receipts?

In the case that you do not have the receipts on hand for matching purposes, you will probably need to take some more action. This is a detailed guide on what to expect if you are being audited without receipts.

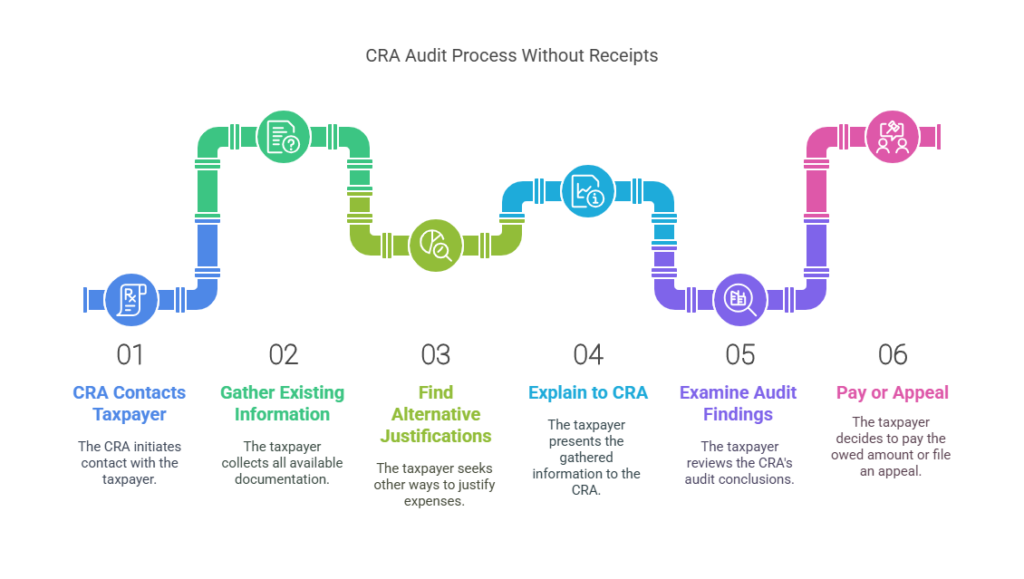

Step 1: The CRA will contact you

Keep in mind that you will only get mail from the CRA.

To verify the audit, call the CRA phone number to confirm the audit.

Step 2: Gather information that you already have

Verify the numbers yourself again before giving the CRA your records. Make it easy for the CRA agent to verify your details and find the info they need in the paperwork. Use references to ‘code’ items so that it’s easy for them to cross-check.

Step 3: Find other ways to justify the expenses you have mentioned

- You can still claim some of your expenses even if you don’t have the receipt. You can use different methods to do this.

- This implies that you will still have to gather as much proof as you can to back up the costs you claimed as deductibles on your tax returns.

While scrolling through Reddit, you will see many discussions as shown below. People share their worries about being audited without receipts. Let’s look at what this could mean for you.

If the thought of an audit without receipts has you worried, take a deep breath. There are ways to recreate your expenses and potentially avoid penalties.

How to Recreate Your Business Expenses Without Receipts

- Ask suppliers or service providers for new copies of their invoices and receipts. The second copy may come with a minor cost.

- Use the bank account statements, credit card statements, and check register at least to indicate the sums you paid.

- Look through your emails for information on business-related purchases and e-mailed receipts.

- You can discover proof of your travels and purchases by logging into your several travel accounts.

- Use the phone number on file to show where your phone has been at the right times. Check its location history. Google account or Apple). Setting up the QuickBooks mileage log app on your phone is also useful.

Step 4: Explain the information to the CRA

If you have been asked to mail documents to the CRA, think about gathering records and sending them off with supporting evidence first. If the CRA agent wants to meet with you, you can review your records. You can also explain the supporting documents you have for each area being investigated.

The CRA officer could ask for more documentation from you. Make an effort to obtain this information as soon as you can. Having a spirit of “cooperation” when dealing with the agent goes a long way. If you push back, they tend to push back even harder.

Step 5: Examine the CRA audit findings

The CRA will calculate what they believe you can deduct. They will also figure out what they think you should have paid in taxes.

They will use the information you provided and their calculations for the minimum standard amounts. The audit findings should be available to you in 30 days.

Step 6: Pay the amount owed or file an appeal against the audit findings

You will have options regarding how to respond to the CRA findings once you have received them.

How can One Accounting help you?

If you are unsure about your documents and explanations, prepare that information ahead of time. Consider talking to a CPA firm about tax rules and laws.

An accounting firm can provide valuable assistance in auditing by employing alternative verification methods and reconstructing financial records. Our tax specialists work closely with businesses. They gather important documents like bank statements, invoices, and electronic transaction records.

We also guide small businesses in establishing robust bookkeeping procedures for future transactions to maintain financial records.

Conclusion

Ultimately, the best approach is proactive. If the question “What happens if you get audited and don’t have receipts?” worries you, it’s time to improve your record-keeping. Maintain meticulous records of all your expenses throughout the year. If you need any kind of support from professional accountants, contact us today!

This prepares you for a possible audit. It also helps you get the most deductions and lower your tax bill. Keep in mind that organized record-keeping is an investment. It can save you time, money, and stress in the long run.

Frequently Asked Questions

An audit can be triggered by factors like reporting significantly high deductions compared to your income, discrepancies between reported income and tax forms (e.g., W-2 or 1099), or filing errors. Random selection by the tax authority is also a possibility.

If you’re missing receipts, you can provide alternative documentation, such as bank or credit card statements, invoices, or emails confirming the expenses. A well-maintained logbook or calendar notes can also support your claims.

Yes, the IRS or CRA may disallow deductions if you fail to provide sufficient proof of your expenses. However, alternative forms of evidence may be accepted in some cases.

The Cohan Rule allows taxpayers to estimate certain expenses if they lack complete documentation. However, you must provide a reasonable basis for the estimate, and it’s subject to the tax authority’s discretion.

Organize and gather alternative documentation, such as bank or credit card records, payroll summaries, or third-party confirmations. Be prepared to explain how the expenses relate to your income or business.

Potential penalties depend on the nature of the issue. If the lack of receipts leads to disallowed deductions or underreported income, you may owe additional taxes, interest, and penalties for negligence or underpayment.

Yes, you can try to reconstruct records by obtaining duplicates of receipts from vendors or service providers. Additionally, credit card and bank statements can serve as a starting point for recreating an expense history.

To avoid future issues, develop a habit of keeping organized records, both physical and digital, for at least 3–7 years (depending on local tax rules). Use expense-tracking apps or software to maintain clear documentation of all financial activities.