7 Important Tax Changes in Canada 2024

Several significant modifications have been planned as we approach the tax year 2024, affecting multiple aspects of the tax system.

Knowing these changes is crucial for making wise financial decisions, whether you are an individual managing personal tax obligations or a business owner adjusting to new corporate tax laws.

We’ll go over seven significant tax changes that will impact Canadians in 2024 in this guide, along with their implications and potential effects on taxpayers.

1. Canada Pension Plan (CPP) Enhancement

The Canada Revenue Agency estimates that in 2024, the CPP payments will rise by 4.4%. The payment of these benefits is scheduled to happen between January and December of 2024.

When you retire, a portion of your income is replaced by the monthly, taxable Canada Pension Plan (CPP) retirement pension. You will be paid the CPP retirement pension for the balance of your life if you are eligible. You must have made at least one legitimate CPP contribution and be at least 60 years old to be eligible.

The annual cap is periodically modified by changes in Canada’s CPI. Additionally, the amount of the monthly payment is raised in line with changes in the cost of living.

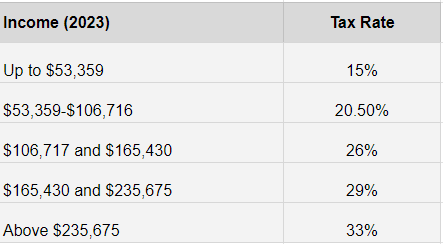

2. New Federal Tax Brackets

The federal government has changed the tax brackets once more for the 2023 tax year because inflation has been strong over the past year. Since the 2022 levels for each bracket were raised, taxpayers will pay a smaller percentage of their yearly income on average. The federal tax brackets for 2023 are as follows.

3. The Alternative Minimum Tax

The Alternative Minimum Tax (AMT) rate will rise from 15% to 20.5% and the basic exemption will rise from $40,000 to around $173,000. Furthermore, a wider range of taxable income will be included in the AMT calculation base.

Individuals who receive a significant portion of their income from tax-preferential sources (like capital gains) or who have significant deductions or expenses that lower their tax obligations under the ordinary rules (like certain interest charges or non-capital loss carryovers) will be impacted by the proposed AMT regulations, whether they are residents of Canada or not.

High-income taxpayers will be affected by these changes, especially those who (and trusts) realise significant capital gains, especially if those gains aren’t qualified for the capital gains deduction (CGD).

The purpose of the AMT is to guarantee that every person, including trusts, pays their fair amount of taxes. People are required to pay the AMT or ordinary tax, whichever is higher when they file their tax return.

4. EI Premium Rate Increase

Employment Insurance (EI) is a key benefit that can maintain your financial security when you’re unemployed. If you meet the eligibility requirements for the EI maximum 2024, you will receive, up to a maximum, 55% of your average weekly insurable wages.

In 2024, the highest yearly sum that can be reimbursed is $63,200. This indicates that $668 is the maximum salary you might receive each week.

As a result, an insured worker’s insurance premiums on salaries up to $61,500 will need to be paid in 2023. The maximum weekly EI payment rate has increased from $638 to $650.

5. Carbon Tax Increase

On April 1, 2024, the federal carbon tax in Canada will increase from $65 to $80 per tonne, raising the cost of carbon tax per litre of petrol. This translates to increased fuel costs for automobiles; a family filling up a 70-litre minivan should budget an additional $12.32 each time.

A price on carbon, or carbon tax, is based on emissions from fossil fuel sources such as coal, oil, natural gas, and petrol. The amount of this tax depends on how much carbon dioxide this fuel emits when in use. Thus, the carbon tax’s goal is to encourage individuals and businesses to consume less fuel.

6. TFSA Dollar Limit Increase

The maximum contribution to a Tax-Free Savings Account (TFSA) is rising from $6,500 in 2023 to $7,000 in 2024. The yearly TFSA contribution cap, which is rounded to the nearest $500 and linked to inflation, is announced annually by the Canada Revenue Agency (CRA).

A registered tax-advantaged savings account that allows you to earn money without paying taxes is called a Tax-Free Savings Account (TFSA).

A TFSA allows you to hold qualifying investments including cash, stocks, bonds, and mutual funds. You can also take withdrawals of contributions, interest, capital gains, and dividends at any time, all without having to pay taxes or record the withdrawals as income when you file your taxes.

7. RRSP Dollar Limit Increase

The maximum amount that may be contributed to a (Registered Retirement Saving Plan) RRSP for the 2024 tax year is $31,560, and the maximum amount that can be contributed to an RRSP for the 2025 tax year is $32,490. Any RRSP contribution room that you are not able to use in a given year can be carried forward.

RRSP is the retirement savings plan is one that you establish that you, your spouse, or your common-law partner contribute to. You can use deductible RRSP contributions to lower your taxable income.