How to pay Personal Taxes to the CRA?

Paying personal taxes to the Canada Revenue Agency (CRA) can be done through several convenient methods. It’s important to ensure that your payment is made on or before the due date to avoid interest and penalties.

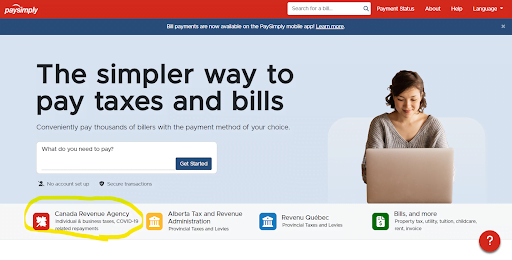

You can use third-party service providers to pay with a credit card, PayPal, or Internet e-Transfer. One of the third-party service providers is “Paysimply”.

1. Open the website paysimply.ca

2. Click on Canada Revenue Agency

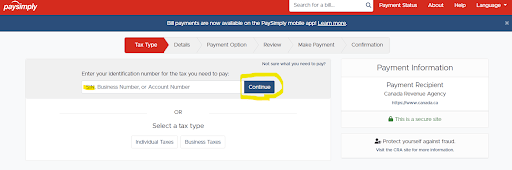

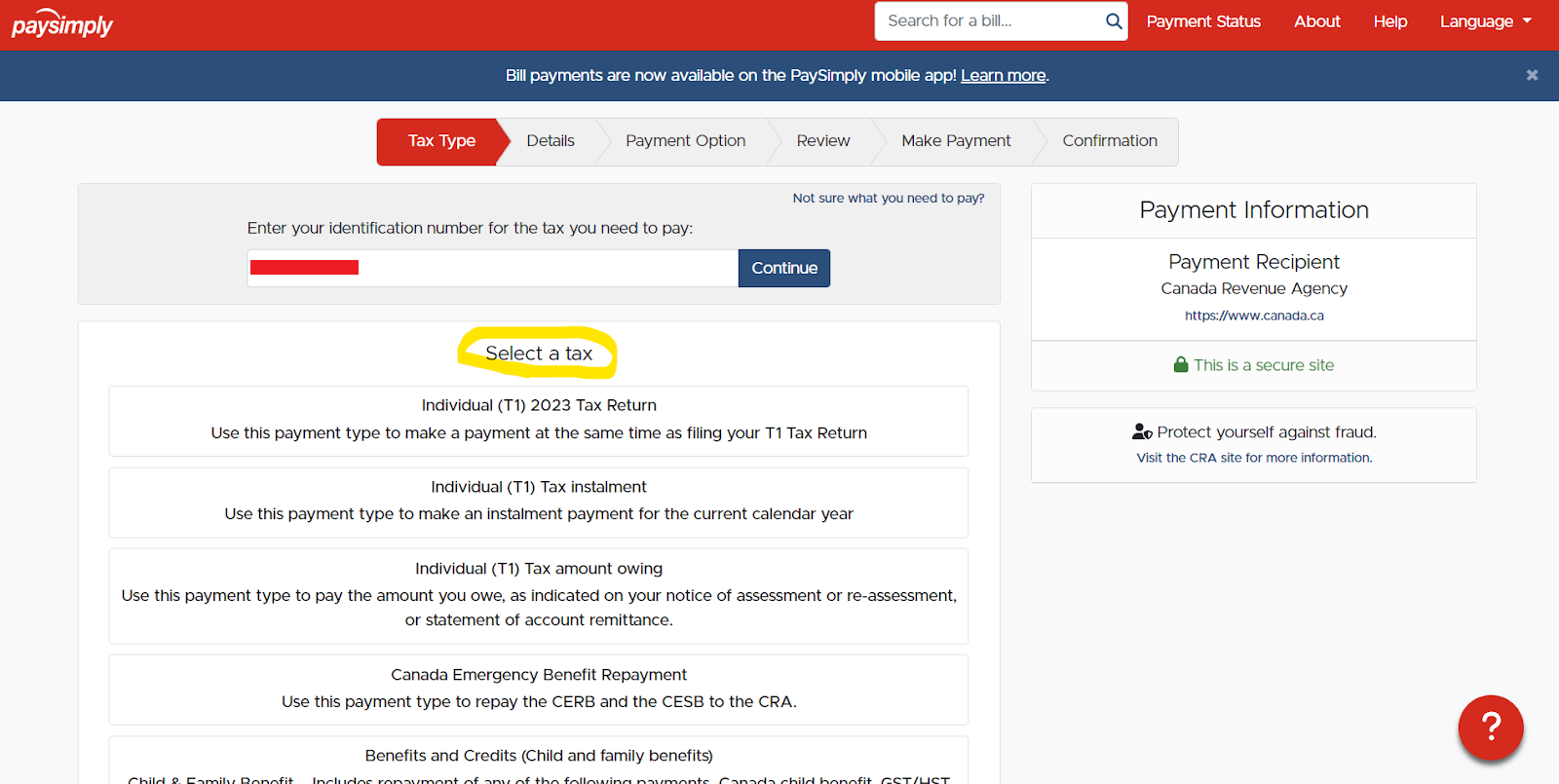

3. Enter your SIN, Business Number or Account Number and click Continue

4. Select the payment type

- Individual Tax return – for amounts owed on your tax return after it was filed

- Individual Tax instalment – for prepayments during the tax year

- Individual Tax amount owing – for payment of any other amounts owed on taxes

- CERB repayment – for CERB repayment options

- Benefits and Credits – for repayments of any credits received that CRA has required repayment on

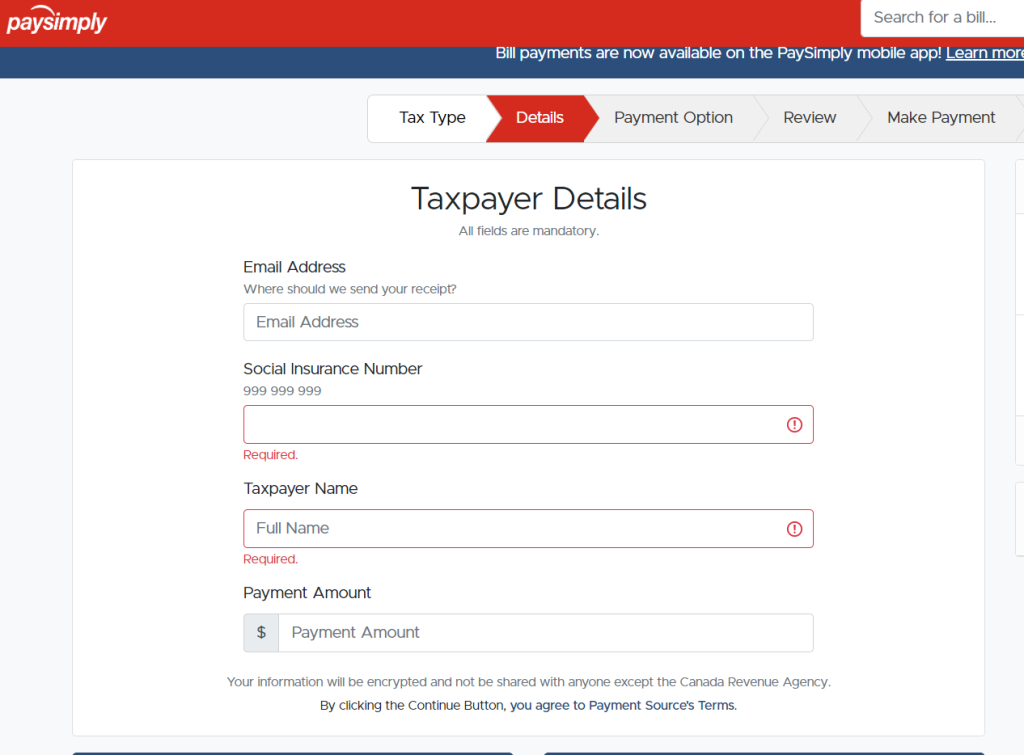

5. Complete the required information

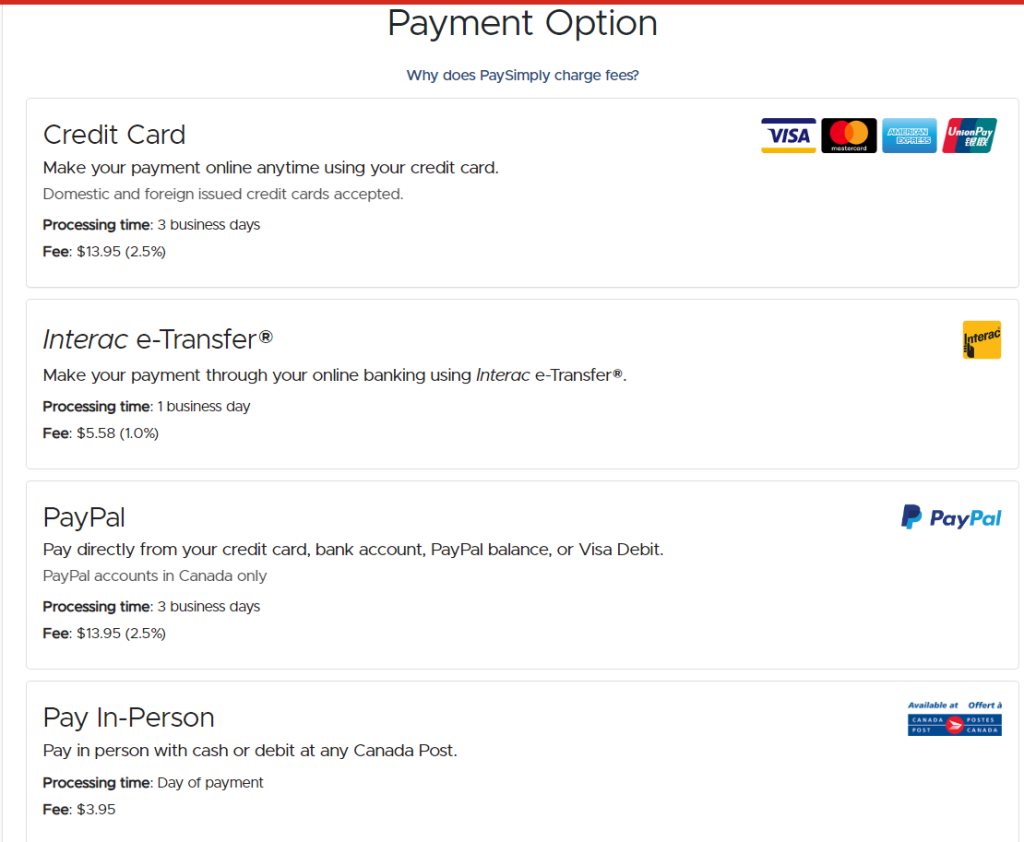

6. Choose a payment option that works for you (keeping the fees in mind)

7. On the next page you will get to confirm all the information you entered.

Share:

Recent Blogs

The Basics of Accounting Services Every Business Should Know

2 February, 2026

Inheritance Tax in Canada: What Happens When You Inherit

2 February, 2026

Canada Capital Gains Tax: A Complete Guide for Property Sellers

29 December, 2025

How to Calculate Sales Tax in Ontario

28 November, 2025

Self-Employed Tax Filing: Everything You Need to Know

21 November, 2025

GST Tax Returns in Canada

3 November, 2025

Toronto Property Tax Lookup – A Complete Guide

23 October, 2025

Comparing $105,000 Salary vs. Dividend from a Corporation

9 October, 2025

Line 23600 Tax Return: What You Need to Know Before Filing in 2025

30 September, 2025

Everything You Need to Know About Quebec Payroll

23 September, 2025