How to Use My CRA Business Account to Authorize a Representative

Adding an authorized accountant as your representative with the Canada Revenue Agency (CRA) allows them to access your account information and deal with the CRA on your behalf.

Adding an authorized accountant as your representative in the CRA system enables them to manage your tax matters efficiently on your behalf.

Who can be a Representative?

Your representative can be an individual or a group you trust to handle your tax matters. Here are the types of individuals who can serve as your representative:

- an accountant

- a bookkeeper

- another family member

- your spouse or common-law partner

- a lawyer

- a friend

- an executor

- a power of attorney

- a customs broker

How to Authorize a Representative?

- By Phone CRA – If you choose this option, your accountant might only be able to provide you with limited information over the phone.

- By mail the signed authorization form to CRA – your accountant might only be able to provide you with limited phone support.

- Through the CRA My Business Account login – your accountant may have complete access, including phone access and the ability to access your business information on the CRA website based on your selections.

Levels of Authorizations

- Level 1 – your accountant can only view the information

- Level 2 – your accountant can view and change the information.

- Level 3 – Your accountant may assign authority or designate an alternate representative.

How to Create a CRA My Business Account?

- Open the CRA Website by clicking this link, CRA My Business Account

- Click Sign-In Partner. Using your banking ID and password, you can access this page.

- Or click CRA Register (If you don’t want to use your banking information).

- Complete the necessary fields. Create your password and login ID. You will now receive an access/security code by mail from CRA, which you need to activate this account. Never give your accountant access to your CRA login credentials.

- Add your business numbers as soon as your CRA My Business account is activated.

How to Create a CRA My Account?

Regarding your personal income tax, use “CRA My Account”. In addition to many other options, you can view or download your Notice of Assessment, view your RRSP and TFSA limit, and view all income tax returns (T1) filed with the CRA. You may also give your representative authorization.

- Open CRA Website – CRA My Account

- Click Sign-In Partner

- Or click CRA Register (If you don’t want to use your banking information).

- Complete the necessary fields. Create your password and login ID. You will now receive an access/security code by mail from CRA, which you need to activate this account. Never give your accountant access to your CRA login credentials

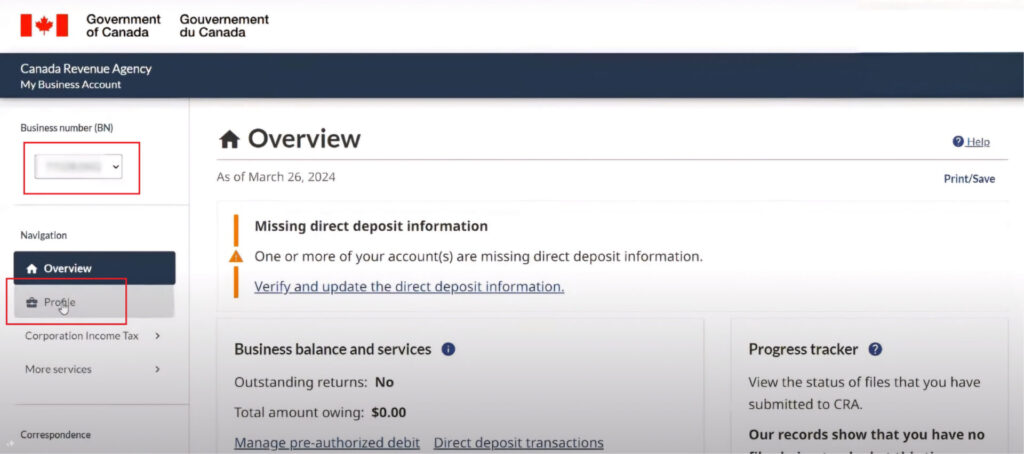

How to Authorize Your Bookkeeper Through the CRA My Business Login?

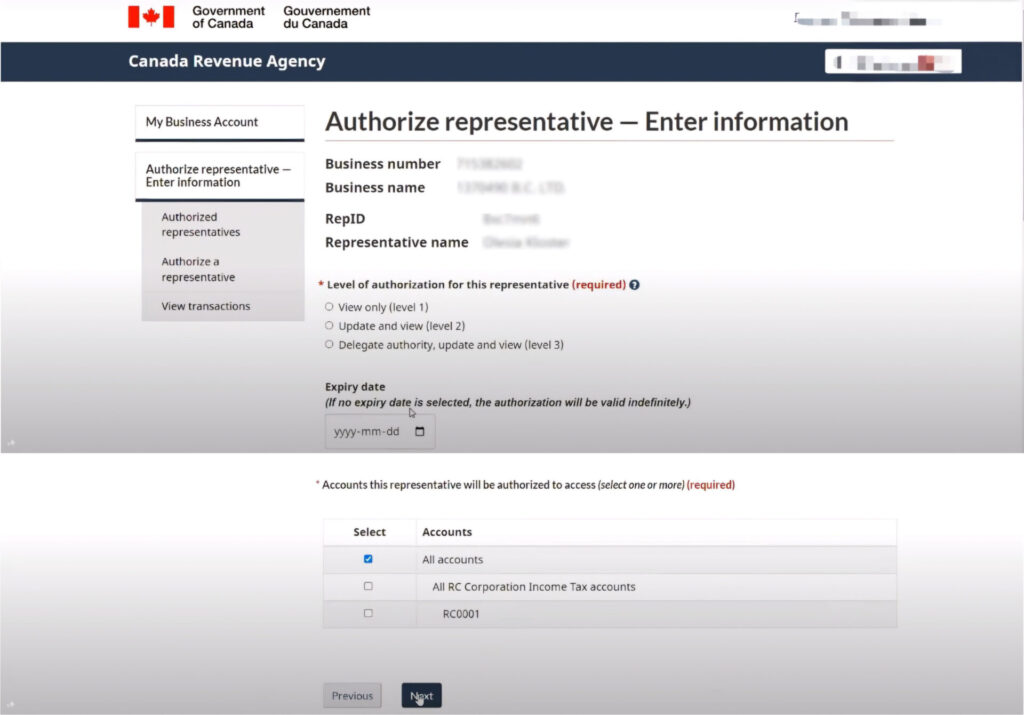

- Select the right “business number” that needs to be authorized.

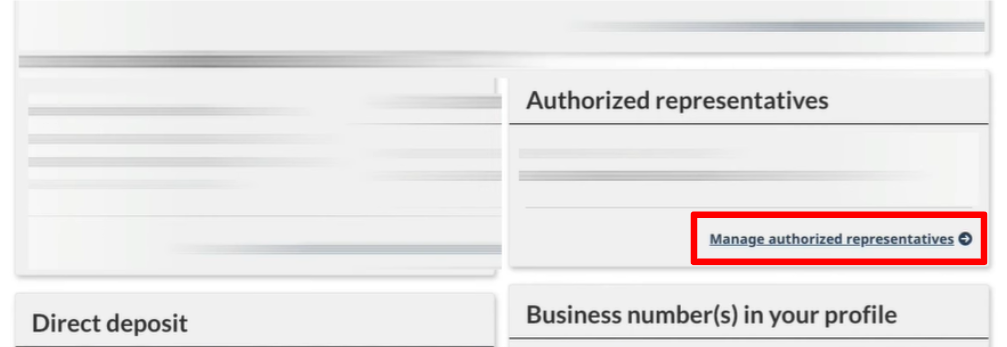

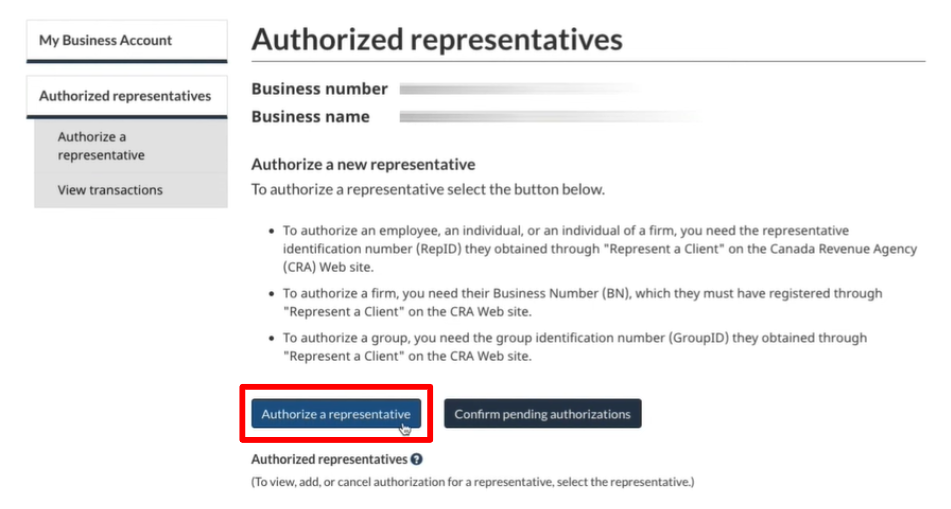

- Click the profile tab and then search under “authorized representatives” for “Manage Authorized Representatives.“

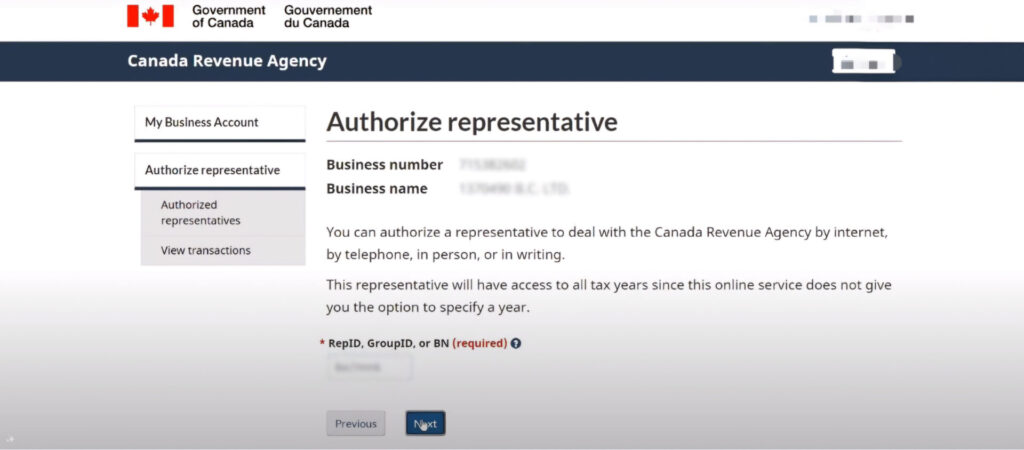

- Enter the Rep ID of the CRA representative that your accountant has given you. To let you know, all Canadian accountants are required to complete a background check, register with the CRA, and get a representative ID.

- Select the levels of authorization. We suggest granting the highest available level of authorization to your accountant (usually level 3)

- The expiration date Keep it empty

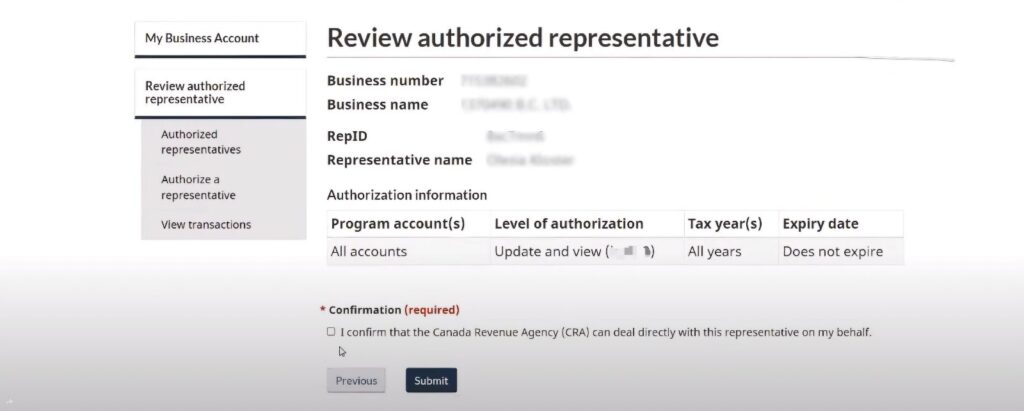

- Review authorized representative

- Inform your accountant that you have permitted them.

What Your Representative Can Do?

By authorizing a representative, you are allowing them to act on your behalf about trust, business, personal, or non-resident taxes. Your representative may do any or all of the following with permission:

- Obtain your tax data, assessment, or reassessment

- Find out more about your tax accounts for business

- Update a portion of your program account information and business number

- Entry Details of your non-resident tax account

- Update a few details related to your non-resident tax account

- Access information about trust accounts updated with information

By consulting their Client List in Represent a Client, you can confirm their authorization levels and your name on your account (this does not apply to non-resident accounts).

Until you, they, or the authorization request’s expiration date is met, your representative’s access to your tax information will remain in effect. Unless your representative was your legal representative, their access will remain valid after the CRA receives notification of your passing.