Cash Flow Problems and How to Solve Them

A Guide for Small Business Cash Flow Problems

Managing cash flow is essential for every business. How much money is coming in versus how much is going out the door? Cash flow problems are a common challenge for small businesses. Poor cash flow management in small businesses can result in a number of difficulties and risks. Meeting routine expenses, such as paying suppliers, paying salaries, servicing debt, etc., can be difficult if there is insufficient cash flow. Penalties or interest costs may result from this.

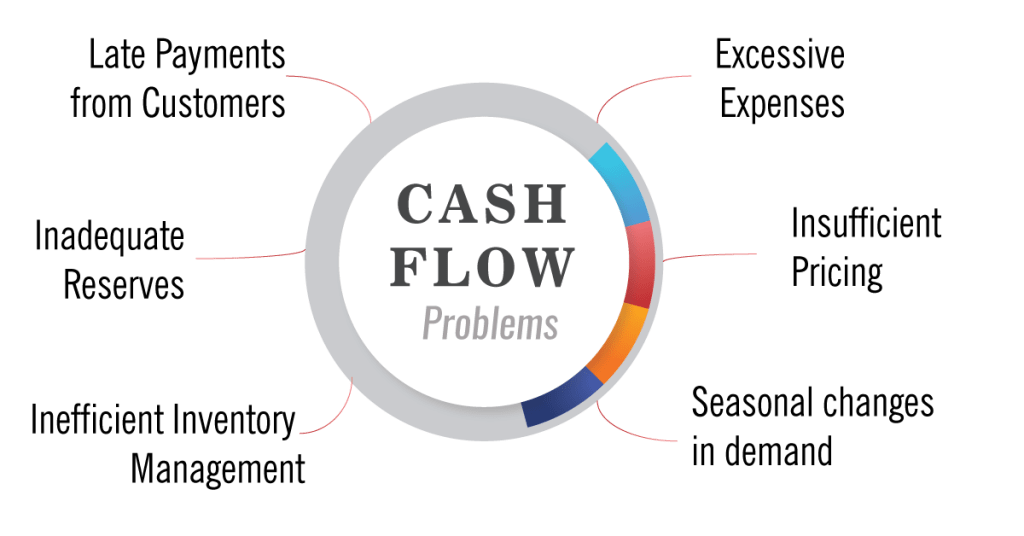

1. Inadequate Cash Reserves

- Daily costs may become tough to pay for if there are insufficient cash reserves.

- During times that have a strong cash flow, save aside a percentage of profits to build up a financial reserve for emergencies.

- Be aware of your spending history and future plans.

- Look at financial options for the future.

- Visit your bank to inquire about obtaining a line of credit so you have a backup plan in case something happens.

2. Late Payments from Customers

- Delays in payments from consumers can impact cash flow.

- To maintain track of cash inflow and outflow, businesses should regularly monitor their account receivables, account payables, and inventories.

- To speed up the collecting process, implement online payment options.

- Offer your customers discounts or other rewards for timely payment.

- Instantly send invoices and follow up with polite reminders.

- Maintain virtual bookkeeping techniques or use this extra money to outsource bookkeeping services.

3. Excessive Overhead or Expenses

- Cash flow can be affected by high fixed costs or unnecessary expenditures.

- Analyze your expenditures in order to find areas where you could possibly save money.

- Speak with vendors and service providers and negotiate for better terms for less expensive options.

4. Inefficient Inventory Management

- Cash flow might be affected by ineffective inventory management.

- Avoid overstocking or understocking items.

- To reduce holding expenses and free up money, use just-in-time (JIT) inventory procedures.

- Make sure everyone on your team has received adequate instruction in inventory management procedures.

5. Insufficient Pricing

- If your prices are too low, your revenue and ability to pay expenses may be affected.

- Conduct market research on pricing trends, client expectations, and competitors’ pricing strategies.

- Determine your desired profit margin based on your company’s objectives, market conditions and industry standards.

- If you want to boost the average transaction value and improve revenue, think about providing bundled packages or discounts.

6. Seasonal changes in demand

Demand fluctuates seasonally for many industries. These changes might result in worse-than-optimal cash flow conditions if business owners don’t take them into consideration. Forecasting for seasonal variations may be made easier for small business owners by using precise sales forecasts and cash flow estimates.

Each business is different, there may be different solutions to cash flow issues. Maintaining proper financial records, closely monitor on your cash flow, and consulting with accounting service firms or business advisors as needed are all crucial.