Annual Return - Federal Corporations

A corporation or business entity is required to file its annual return to the appropriate government authority every year.

This is NOT A TAX RETURN. This return to Corporations Canada is due within 60 days of your incorporation day & month. Once a year, Corporations Canada requires you to file an Annual return with them.

Eligibility

Federal business and not-for-profit corporations can file their annual return online.

What does it cost?

An annual return costs: $12 (online payment)

Step 2 - Choose Sign-in Partner

Sign in Online Portal Sign in using a GCKey (if you have one) or choose a Sign-in partner such as your bank (same login as your online banking).

Step 3 - Select the Corporation

Select the corporation you want to file for. If you can not see the corporation, then click on the Search button

Step 4 - Confirm Details

Confirm that the details of the corporation you picked are correct (i.e. it is the one you want to file for)

Step 5 - Add Contact Information

Insert your contact information

Step 6 - Add Annual Return Information

Fill in the current year and the date of your annual meeting. The corporation’s directors are required to have at least one meeting every year. Or prepare a resolution to waive the meeting. You probably have various management meetings during the year, so you can enter the date of your last meeting.

Most corporations are non-distributing corporations. If your corporation is quoted on the TSX or similar stock exchange, then choose a distributing corporation.

Step 7 - Print & Sign a Copy of Documents

Print and sign a copy of the documents for your records.

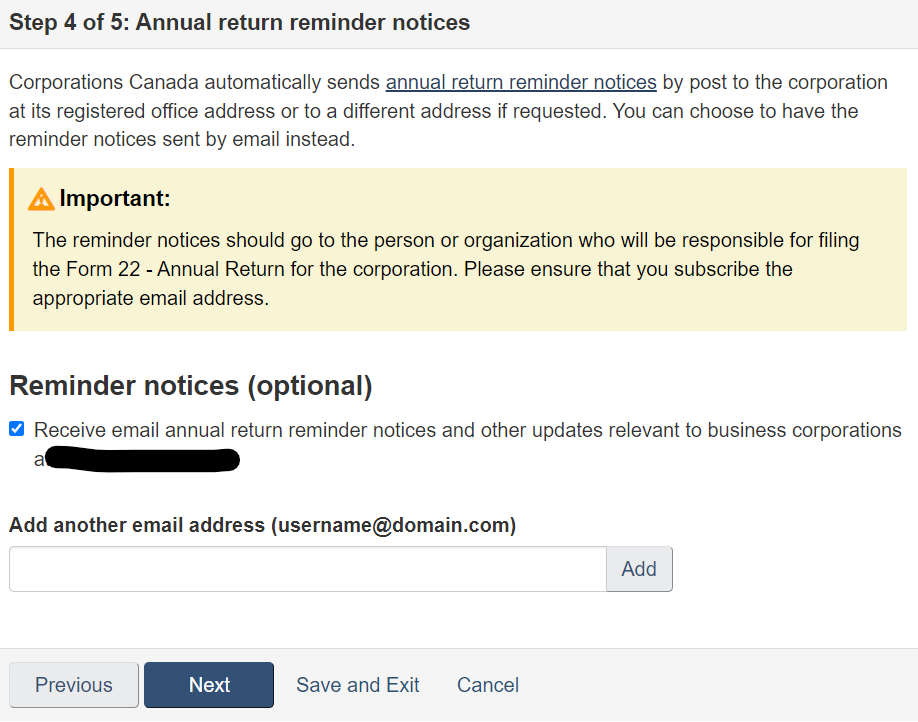

Step 8 - Annual Reminders

Enter your email to receive annual reminder emails to file the return. And then proceed to payment.

Step 9 - Payment

Payment can be made with a credit card. Afterwards, you will see a confirmation like below.