7 Critical Accounting Mistakes Affecting Startups in Calgary: How to Avoid Financial Pitfalls

The business environment in Calgary demands financial precision. From oil and gas ventures to tech innovations, startups face unique financial challenges that require careful navigation. Without proper accounting practices, your promising venture might join the 20% of small businesses that fail within their first year.

At One Accounting, we’ve seen how small financial missteps can snowball into major problems. Let’s explore the most common accounting mistakes in Calgary’s startup ecosystem and how you can avoid them.

Common Accounting Mistakes Affecting Calgary Startups

1. Mixing Personal and Business Finances

- Missed tax deductions that cost you money

- Difficulty qualifying for business loans

- Compliance issues with Canada Revenue Agency (CRA)

Solution: Establish separate bank accounts and credit cards exclusively for your business transactions. This simple step creates a clear financial boundary that protects both your business and personal assets.

2. Neglecting to Keep Accurate Records

Do you put off bookkeeping until tax season? Many Calgary startups delay financial record-keeping, creating a stressful backlog that leads to errors.

It provides real-time insights into your business health, rather than being just about compliance. When you neglect this crucial practice, you risk:

- Missing early warning signs of cash flow problems

- Losing track of valuable tax deductions

- Making business decisions based on outdated information

Solution: Implement a weekly bookkeeping routine or partner with a professional service like One Accounting to maintain accurate, current financial records.

3. Misclassifying Employees and Contractors

- Substantial penalties from the CRA

- Retroactive payments for employment insurance and CPP

- Legal disputes that damage your company’s reputation

Solution: Consult with accounting professionals who understand Alberta’s employment regulations to ensure proper worker classification from day one.

While workforce classification matters greatly, staying compliant with tax obligations requires equal attention.

4. Overlooking Tax Obligations

- Missing GST/HST registration requirements

- Failing to make quarterly tax installments

- Overlooking available tax credits specific to Alberta businesses

Solution: Create a tax calendar with all relevant deadlines and consider working with tax specialists who understand the nuances of Calgary’s business tax landscape.

Beyond tax compliance, managing your day-to-day financial operations presents its own critical challenges.

5. Poor Cash Flow Management

Cash flow problems are the leading cause of business failure, yet many Calgary startups operate without a clear cash flow forecast.

- Inability to meet payroll obligations

- Late payments to suppliers that damage relationships

- Missing growth opportunities due to cash constraints

Solution: Develop detailed cash flow projections and monitor your finances weekly to identify potential shortfalls before they become crises.

- Automated data entry and reconciliation

- Real-time financial reporting and insights

- Secure data storage with audit trails

- Time savings that let you focus on growing your business

Solution: Invest in accounting software suited to your business needs and industry requirements.

7. Underestimating the Value of Professional Advice

Many Calgary entrepreneurs attempt to handle all accounting functions themselves to save money. Ironically, this often proves more expensive when accounting mistakes require costly corrections.

- Industry-specific tax strategies

- Compliance requirements for Calgary businesses

- Financial planning opportunities you might otherwise miss

Solution: Consider professional accounting support as an investment rather than an expense. The right financial guidance can significantly improve your bottom line.

Want a deeper explanation? This video goes into further detail explaining accounting mistakes for startups in Calgary.

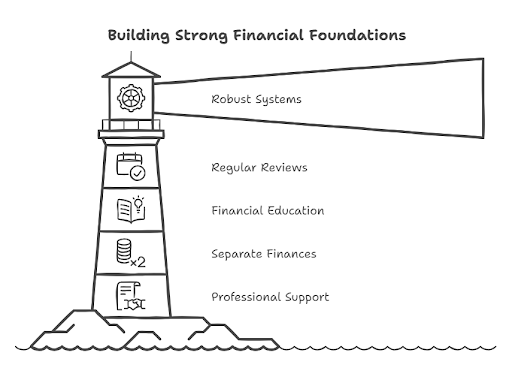

Tips for Avoiding Accounting Mistakes

1. Implement robust financial systems from day one – Start with proper accounting structures before complexities arise

2. Schedule regular financial reviews – Set monthly appointments to review your financial statements

3. Invest in financial education – Understand the basics even if you outsource accounting tasks

4. Separate your business and personal finances immediately – This simple step prevents numerous complications

5. Consider professional support – One Accounting provides tailored solutions for Calgary startups at every growth stage

Conclusion

Remember that accounting isn’t just about compliance. It’s a strategic tool that helps you make informed business decisions. One Accounting offers the expertise Calgary entrepreneurs need to navigate financial complexities with confidence.