What you need to know about Canada's New Dental Care Plan

The Canadian government launched the Canada Dental Benefit To assist in bringing down the cost of dental care. This article will explain the benefits, how to apply, and the eligibility criteria of the dental care plan.

Mark Holland, Canada’s health minister, declared on Monday that “this is the largest coverage rollout in Canada’s history.” The Canadian Dental Care Plan is a $13-billion insurance program launched by the federal government that’s expected to provide basic dental care to about nine million people.

The government estimates that up to 9 million low-income Canadians without insurance of all ages will have access to this new insurance program.

For uninsured Canadians with yearly family incomes under $90,000, the plan will cover dental care; for those with incomes under $70,000, there will be no copays.

Who is eligible?

To be eligible for the Canadian Dental Care Plan (CDCP), you must fulfil the following requirements:

- Residing in Canada and not having access to dental insurance

- Earning less than $90,000 in net family income after adjustments

- Submitted your prior year’s tax return.

Children under the age of 18 will be eligible based on the eligibility of their parent or guardian.

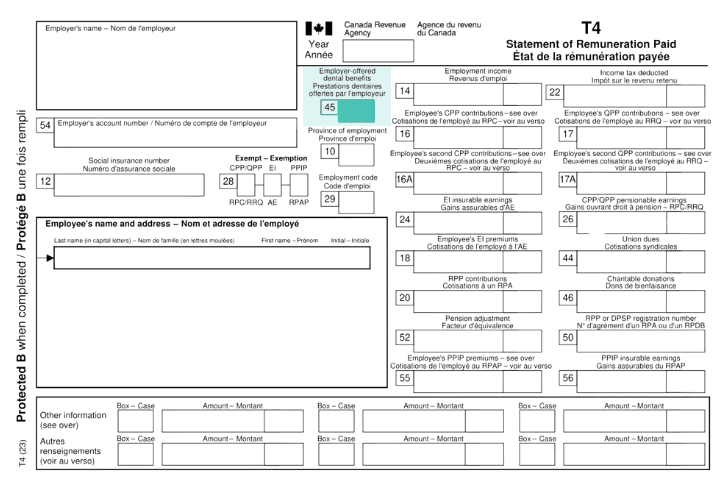

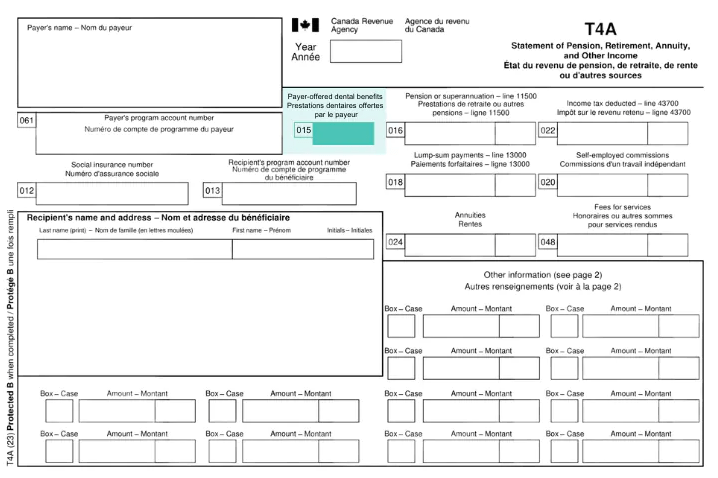

“The law mandates that dental coverage offered by employers be reported on T4 and T4A tax slips”

New reporting requirements for T4s

Box 45 is the new reporting box on the 2023 T4 Slip, and you have to choose one of the following options:

- Not qualified for any type of dental insurance or coverage for dental services

- Coverage/ access for the payee only

- Coverage/ access for the dependent children, spouse, and payee

- Coverage/ access for the spouse of the payee

- Coverage/ access Accessibility and coverage for the payee and any dependent children

For 2023 the reporting requirement is for employer provided dental benefits.

New reporting requirements for T4As

Box 015 is the new reporting box on the 2023 T4A Slip, which is optional unless a sum is reported in Box 016, Pensions and Superannuation. When filling out box 015, you have to choose one of the following:

- Not qualified for any type of dental insurance or coverage for dental services

- Coverage/ access for the payee only

- Coverage/ access for the dependent children, spouse, and payee

- Coverage/ access for the spouse of the payee

- Coverage/ access for the payee and any dependent children

Contact One Accounting for advice on the Canadian Dental Care Plan

Our proficient accountants are available to assist!

If you have any questions about the T4/T4A reporting requirements or the Canada Dental Care organize, please contact us.