5 Ways a Calgary Tax Accountant Can Help You Cut Costs

This is where the expertise of a skilled tax accountant in Calgary can make all the difference.

But why exactly do you need a tax accountant? Let’s go deeper.

Why A Tax Account in Calgary?

Here is a thread expanding even more why businesses are looking for help in filing corporate taxes.

By partnering with a reputable firm like One Accounting, you gain access to a team of experienced professionals who are dedicated to helping you achieve your financial goals.

1. Avoiding Costly Mistakes

One of the most significant benefits of working with a tax accountant in Calgary is their ability to help you avoid costly mistakes.

- A tax accountant in Calgary files your tax returns correctly and on time, minimizing the risk of errors.

- They regularly review tax laws and regulations to ensure your compliance, providing you with peace of mind and protecting your financial well-being.

- Underpaying or overpaying taxes: Incorrectly calculating your taxes can lead to underpayment or overpayment, both of which can have negative consequences. Underpaying taxes can result in penalties and interest charges, while overpaying means you are giving the government an interest-free loan. A tax accountant can ensure that you pay the correct amount of taxes.

- Missing important deadlines: Tax deadlines are strict, and missing them can result in penalties and interest charges. A tax accountant can help you stay on top of important deadlines and ensure that your tax returns are filed on time.

- Failing to keep accurate records: Accurate record-keeping is essential for tax purposes. A tax accountant can help you develop a system for organizing your financial records and ensure that you are keeping the necessary documentation.

Now, let’s dive into how handling complex financial situations with the right expertise can further bolster your financial well-being.

2. Handling Complex Financial Situations

- Managing GST/HST filings and business expenses: Businesses are required to file GST/HST returns and keep track of their expenses. A tax accountant can help you manage these filings and ensure that you are claiming all eligible business expenses.

- Optimizing tax deductions: Businesses are entitled to various tax deductions, such as those related to home office expenses, vehicle expenses, and capital cost allowances. A tax accountant can help you optimize these deductions to minimize your tax liability.

- Advising on optimal business structures for tax efficiency: The structure of your business can have significant tax implications. A tax accountant can advise you on the most tax-efficient structure for your business, whether that is a sole proprietorship, partnership, or corporation.

- Handling multi-source income: If you have income from multiple sources, such as employment, self-employment, and investments, a tax accountant can help you navigate the tax implications and ensure that all your income is accurately reported.

- Managing rental properties: Owning rental properties comes with its own set of tax rules and regulations. A tax accountant can help you understand these rules and ensure that you are claiming all eligible expenses related to your rental properties.

- Navigating the tax implications of investments: Different types of investments have different tax implications. A tax accountant can help you understand the tax consequences of your investments and develop strategies to minimize your tax liability.

Next up, let’s tackle one of the most stressful scenarios a taxpayer can face the dreaded CRA audit.

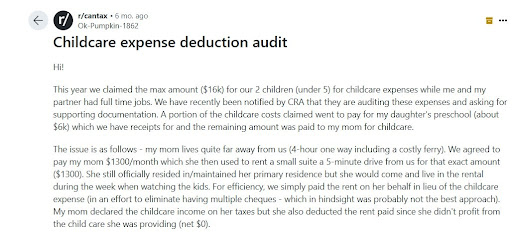

3. Support During CRA Audits

Facing a Canada Revenue Agency (CRA) audit can be a stressful and intimidating experience. Having a tax accountant in Calgary by your side can make a significant difference in how the audit unfolds.

- Representation in communications with the CRA: A tax accountant can act as your representative in dealings with the CRA. They can communicate with the CRA on your behalf, answer questions, and provide explanations as needed.

- Providing necessary documentation and records: During an audit, you will provide various documents and records as requested by the CRA. A tax accountant can help you gather and organize these documents, ensuring that you provide the CRA with everything they need.

- Implementing strategies to minimize potential penalties and resolve disputes: If the audit reveals any issues or discrepancies, a tax accountant can work with you and the CRA to resolve these disputes. They can negotiate on your behalf and implement strategies to minimize any potential penalties.

4. Maximizing Tax Deductions and Credits

- The Alberta Climate Action Incentive: This incentive is designed to help offset the cost of the federal carbon tax for Alberta residents. A tax accountant can help you understand if you’re eligible for this credit and ensure that you receive the full amount you’re entitled to.

- Home office expenses: If you work from home, either as an employee or a self-employed individual, you may be able to claim a portion of your home expenses as a tax deduction. This can include things like rent, utilities, and maintenance costs. A tax accountant can help you determine what expenses are eligible and how to calculate the deduction.

- Childcare expenses: If you have children and pay for childcare so that you can work or attend school, you may be able to claim these expenses as a tax deduction. This can include daycare fees, babysitting costs, and even summer camp expenses. A tax accountant can help you understand the rules around claiming childcare expenses and ensure that you’re taking full advantage of this deduction.

5. Strategic Tax Planning

- Contributing to RRSPs (Registered Retirement Savings Plans): Contributing to an RRSP is one of the most effective ways to reduce your taxable income and save for retirement. A tax accountant can help you understand how much you can contribute, the tax benefits of contributing, and how to choose the right investments for your RRSP. They can also help you plan your contributions to maximize your tax savings both now and in the future.

- Splitting income with family members: Income splitting is a tax strategy where income is shifted from a higher-income family member to a lower-income one to reduce the overall tax burden. There are several ways to do this, such as through spousal RRSPs, pension income splitting, and hiring family members in a business. A tax accountant can help you understand which income splitting strategies may work for your situation and guide you on implementing them effectively.

- Managing investments for tax efficiency: The way you manage your investments can have a big impact on your tax bill. A tax accountant can advise you on strategies to minimize the tax you pay on your investment income, such as using tax-advantaged accounts like TFSAs (Tax-Free Savings Accounts), timing your capital gains and losses, and choosing tax-efficient investments. They can also help you understand the tax implications of different investment decisions and guide you on structuring your portfolio for optimal tax efficiency.

Customized Financial Advice

- Optimizing your business structure for tax efficiency: Whether you are looking to optimize your business structure for tax efficiency, plan for long-term wealth accumulation, or reduce your overall tax burden, our tax accountants provide customized advice and solutions.

- Developing a comprehensive financial plan: We work closely with you to develop a comprehensive financial plan that takes into account your current situation, future goals, and risk tolerance.

- Business succession planning: If you are a business owner, planning for the future of your business is crucial. Our tax accountants can help you develop a succession plan that minimizes tax implications and ensures a smooth transition.

- Estate planning: Effective estate planning can help you minimize taxes and ensure that your assets are distributed according to your wishes. Our tax accountants work with you to develop an estate plan that considers your unique family situation and financial goals.

Conclusion

Engaging the services of a tax accountant in Calgary, like those at OneAccounting, is a smart investment in your financial future. By leveraging their expertise, you can maximize your tax savings, avoid costly mistakes, and navigate complex financial situations with ease.

One Accounting’s team of experienced Certified Public Accountants (CPAs) is dedicated to providing comprehensive accounting and financial services tailored to your unique needs. Our tax accountants stay up-to-date with the latest tax laws and regulations, ensuring that you are always in compliance and taking advantage of all available opportunities for savings.